* ENGLISH VERSION PLEASE SCROLL DOWN BELOW, THANK YOU

如何申請EPF RM10000 一次性特别提款 2022

4月1日开放申请EPF提款RM10,000,政府宣布,第四次开放公积金 EPF 提款,帮助受到冠病疫情影响的国民,为应付开销和减轻压力,允许年龄55岁以下的会员,在4月1日至30日期间,提款1万令吉。

人民对于这次的提款,持有非常多的看法,

这次的提款暂时能为入不敷出的家庭得到缓解,改善目前的生活困境,

相对也有另一部分反对这次同样的应急纾困,毕竟这笔存款也是未来的退休金,

相信大家应该有发现,在 MCO 期间 出现非常多的人群,尤其是 80 与 90 后的人群 更为有效率的规划与分散财务规划,更倾向于 把这笔钱,存放于更合适以及获取更高的回酬。

大家应该也有注意到 公积金 也有持股我们的银行,也接受部分 基金的 转投资,所以这也能更显示我们公司在马来西亚更为稳健,这几十年来在各方面服务都能得到保证,

还是得苦口婆心的希望,在大家一窝蜂的涌进官网申请的同时,可以好好审视自己接下来的财务规划,并把这笔钱存放于更准确的位置,以更稳妥的方式逐步 增加自身的财产,而不是提出存款后不知名的被消失,

公积金网站即日起已经开放给与所有会员申请。

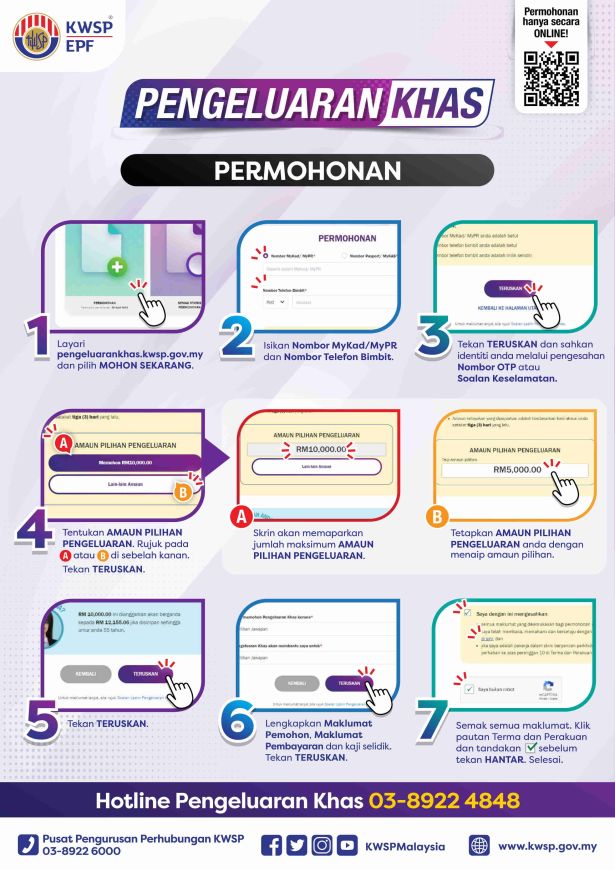

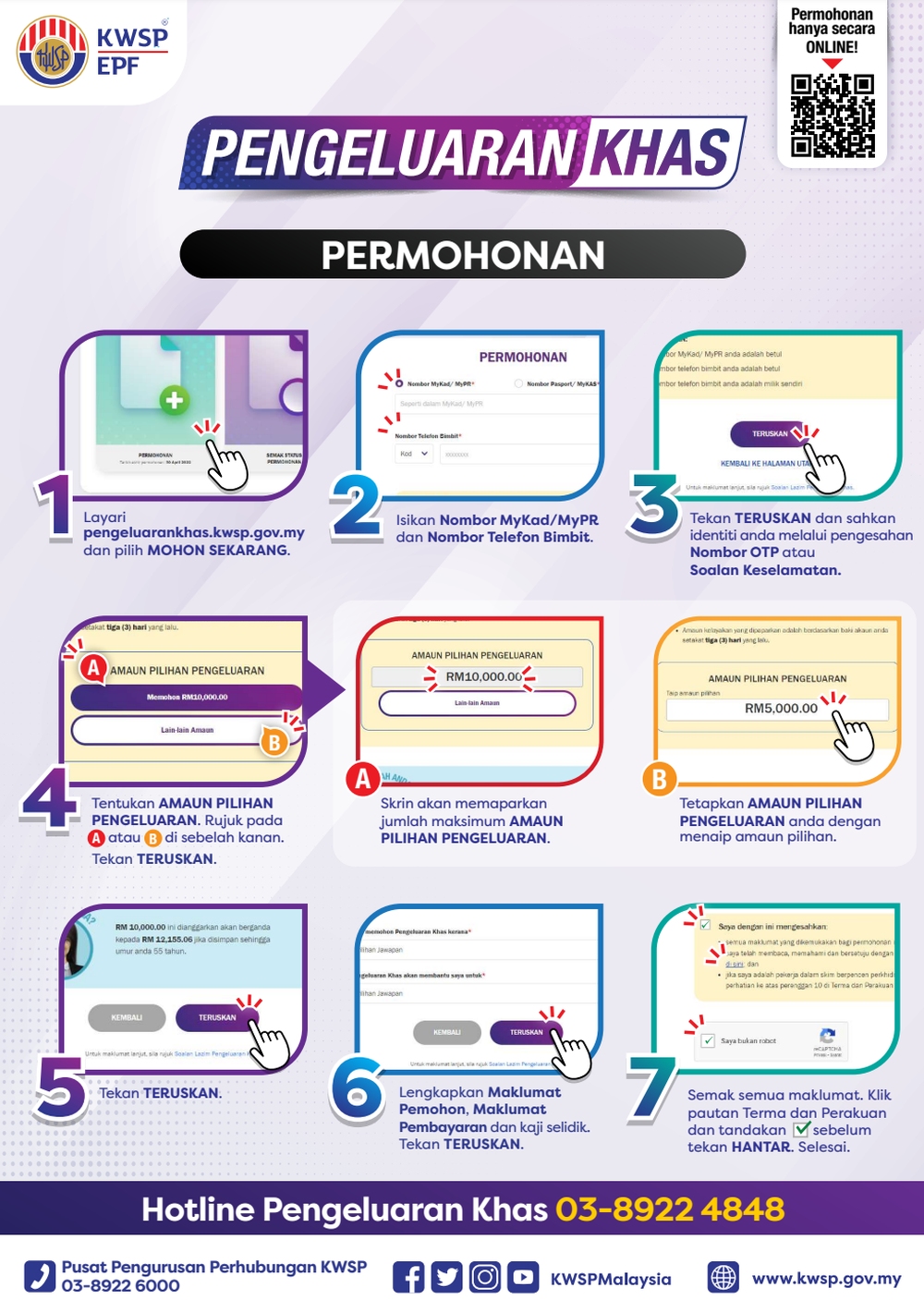

步骤一:登入KWSP官网 https://pengeluarankhas.kwsp.gov.my/submit-khas

申请时间为 01APRIL- 30APRIL 2022

EPF 会员可以直接到官网,或者直接下载 APPS - I ACCOUNT 线上申请,

EPF 会在 20APRIL开始陆续发放这次的提款,也能在 10APRIL 过后到 EPF 官网检查提款申请状况,

步骤二:点击Permohonan

需要申请这次 EPF 的一次性特别提款,申请者需要符合以下条件-

A: 55岁以下的会员

B: 申请者的会员户口最少必须保留 RM100的存款

C: 登记会员必须是是注册最新的手机号码

D: EPF 的存款数额达至提款条件

E: 会员户口必须是活跃户口

F: 登记在EPF 的银行户口必须是个人户口,不能是联名户口或者公司户口

步骤三:输入身份证号码和手机号

步骤四:输入手机收到的·验证码

步骤五:选择申请理由,以及如何帮助我的个别选择,然后点击 TERUSKAN,

即便过往已经申请获取了,也可以申请这次的申请提款,

步骤六:选择要提款的金额,页面会显示最高提款额,以及欲提款数额,

A: 提款最低数额为 RM50

B:提款最高数额为 RM10000

C:注意--申请者不被允许在提交申请后,更改数额或者取消申请

步骤七:EPF系统将会显示你会收到的款项数额以及相关详情

步骤八:点击Teruskan后,需输入个人资料和银行户口资料,并回答简短问卷

步骤九:请阅读里面相关条款和条例后,直接点击Hantar

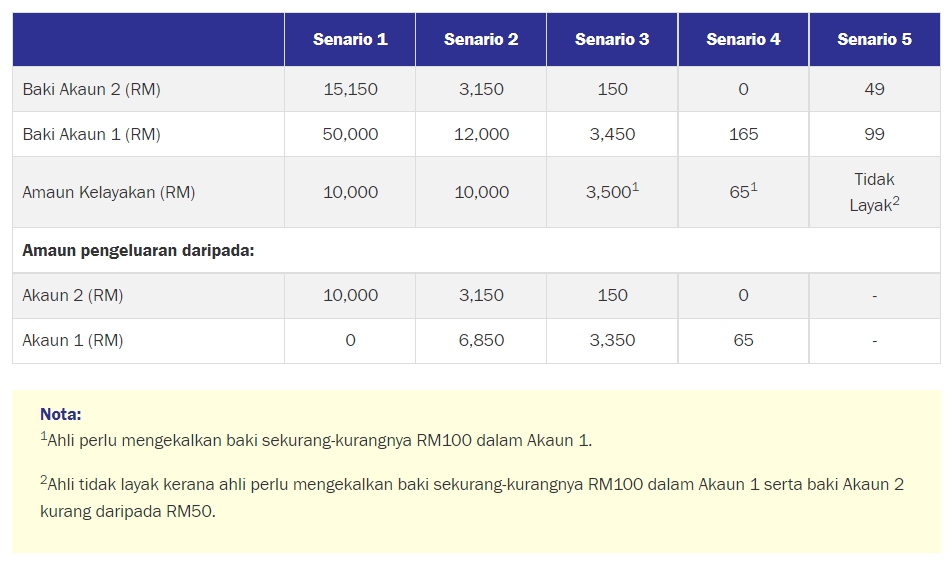

KWSP宣布,会员们会先提取第二户头的存款,若存款不足才会直接提取第一户头的存款。

申请成功后,会员们可以在4月9日后查询结果,最快时间可能在4月20日起一次过收到自己的提款款项。

还有疑问或者申请时无法操作,会员们可以-

电特别提款设施热线:03-8922 4848

点击 官网 : www.kwsp.gov.my

点击 官网 询问 : ASK ELYA

新闻来源:Winrayland, ZingGadget, SparkliangFinance, XuanTV, VIRALCHAM

EPF Withdrawal 10K 2022 (RM10000 One Time)

Berdasarkan pengumuman dan butiran yang ikongsikan oleh pihak Kementerian Kewangan Malaysia (MOF) dan EPF adalah seperti berikut:

- Sesiapa pencarum yang umur 55 tahun ke bawah layak untuk mohon

- Anda boleh memohon secara online bermula dari tarikh 1 April 2022 hingga 30 april 2022

- Tarikh bayaran bermula pada 20 April 2022

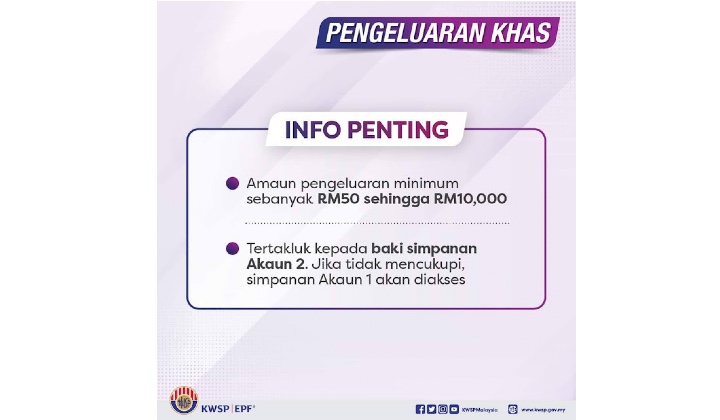

- Anda boleh keluar dari nilai sekelcil Rm50 sehingga ke angka maksimum RM10000

- Sila keluar pada akaun 2 terlebih dahulu, kemudiaan baru boleh akses akaun 1

Nasihat PM Ismail Sabri

- Ini adalah simpanan hari tua anda semua sebagai pencarum kwsp

- Jika anda benar-benar terdesak, gunakanlah duit kwsp withdrawal anda ini sebaiknya

- Jika tiada keperluan untuk withdraw epf anda, seeloknya biarlah duit tersebut simpanan untuk simpanan hari tua anda kelak

- PM berharap anda semua membuat pertimbangan yang sebaik-baiknya demi masa anda dan juga keluarga anda kelak

- Kerajaan telah memberikan kebenaran untuk anda lakukan epf withdrawal 10K seperti yang diinginkan sesetengah pihak. Keputusan ditangan anda sekarang!

SUMBER: https://www.pmo.gov.my/

Who is eligible for the RM10,000 EPF withdrawal?

According to EPF, the special withdrawal facility is open to all contributors aged below 55 years old. Besides Malaysians, it is also open to non-citizens as well as permanent residents. EPF members must have at least RM150 in their EPF account at the time of application.

How to apply for the RM10,000 EPF withdraw?

EPF withdrawal.

The payout for the special withdrawal will be disbursed to your registered bank account starting on 20th April 2022.

How much can you withdraw?

Eligible members can apply to withdraw from a minimum of RM50 to a maximum of RM10,000. However, there must be at least RM100 remaining in Account 1 after the withdrawal. According to EPF, this is to maintain the status of an active member.

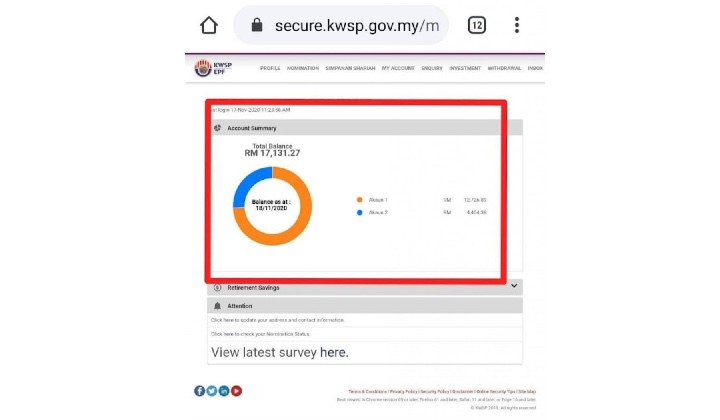

As shown in the above example, the withdrawal will fully utilise Account 2 first before utilising Account 1 if there’s insufficient balance. If you don’t have RM150 in total (Account 1 + Account 2), you are not eligible to withdraw.

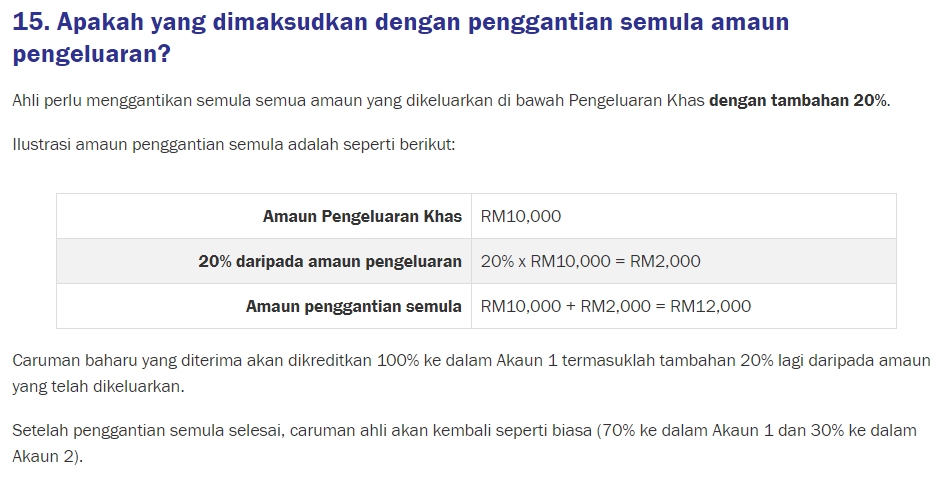

Do you need to repay back?

After making the withdrawal, you do not need to increase your monthly EPF contribution for repayment. However, the percentage of subsequent EPF contributions will be prioritised to Account 1 until it has been replenished with the desired amount.

According to the EPF, the replenishment of Account 1 will include an additional 20%. This means if you have withdrawn RM10,000, EPF will set to replenish a total of RM12,000 to Account 1 before resuming the usual distribution of 70% to Account 1 and 30% to Account 2 for your subsequent EPF contributions.

To recap, Account 1 is meant for retirement, while Account 2 can be used for other purposes including housing, medical, reducing loan repayment, education and haj.

SUMBER: soyacincau.com

Applications for the special withdrawal will be open to members under the age of 55 starting 1 April and ending at the end of next month.

The EPF said in a statement that the payment period will start on 20 April, 2022.

How To Check the Latest EPF Account Balance

- To check your latest EPF balance, please refer to the following steps:

- Login to EPF i-Account: https://secure.kwsp.gov.my/member/member/login

- Go to the Account menu

- Click on ‘Current Year / Previous Year Statement’

- Click View Details

- The information will be displayed as below.

Total Withdrawals Allowed

EPF members are allowed to withdraw a maximum amount of RM10,000 and a minimum of RM50.

They have to withdraw from the savings balance in their Account 2 before accessing the savings in Account 1.

EPF mmembers can mafe the withdrawal at https://pengeluarankhas.kwsp.gov.my/ through the i-Account starting 1 April.

But what is the difference between Account 1 and 2 in EPF?

Effective 1 January 2007, a member’s EPF savings consists of two accounts that vary by their share of savings and withdrawal flexibilities.

Account 1 stores 70% of the members’ monthly contribution, while the second Account 2 stores 30%.

How Malaysians Spend Their EPF Money

Malaysians had been withdrawing the EPF money for investment purposes such as buying gold or stocks, according to a study by the UCSI Research Center.

The survey involved 809 respondents from across the country who have or were planning to apply for i-Sinar.

According to the study, the T20 group made up 47.7 per cent of the contributors who withdrew i-Sinar money for investment purposes, followed by M40 at 35.3 per cent and B40 at 31.1 per cent.

Overall, they made up 34.9 per cent of the total respondents who stated that the withdrawal of i-Sinar money was for investment purposes.

A total of 55.5 per cent of EPF contributors used i-Sinar money to pay monthly insurance, followed by the purchase of kitchen items and food (48.6 per cent).

Other purposes include home renovations (32 percent), gadget purchases (24.1 percent) and saving in bank accounts (18.4 percent).

The UCSI Research Center also found that repaying loans was the main purpose for respondents to make i-Sinar withdrawals for the B40 and M40 groups, as well as those aged between 26 to 55 years.

任何咨询,可随时直接联络 -

.jpg)

No comments:

Post a Comment